About Texas Ragtime

TRI Mission Statement

Texas Ragtime, Inc. is committed to green initiatives and recycling efforts through the community. We partner with companies nationwide to raise public awareness of the importance of the reuse and repurposing of post-consumer textiles of all types.

We are committed to the highest standards of customer service and strive to deliver products to your door within the shortest time frame possible. Our wiping products suit various industrial and commercial uses, including painting, oil field work, marine, manufacturing, and any general clean up requirements.

We carry reclaimed woven wipers, new textile wipers, and absorbent products. All are carefully inspected and processed to ensure high quality and consistency.

Our Story

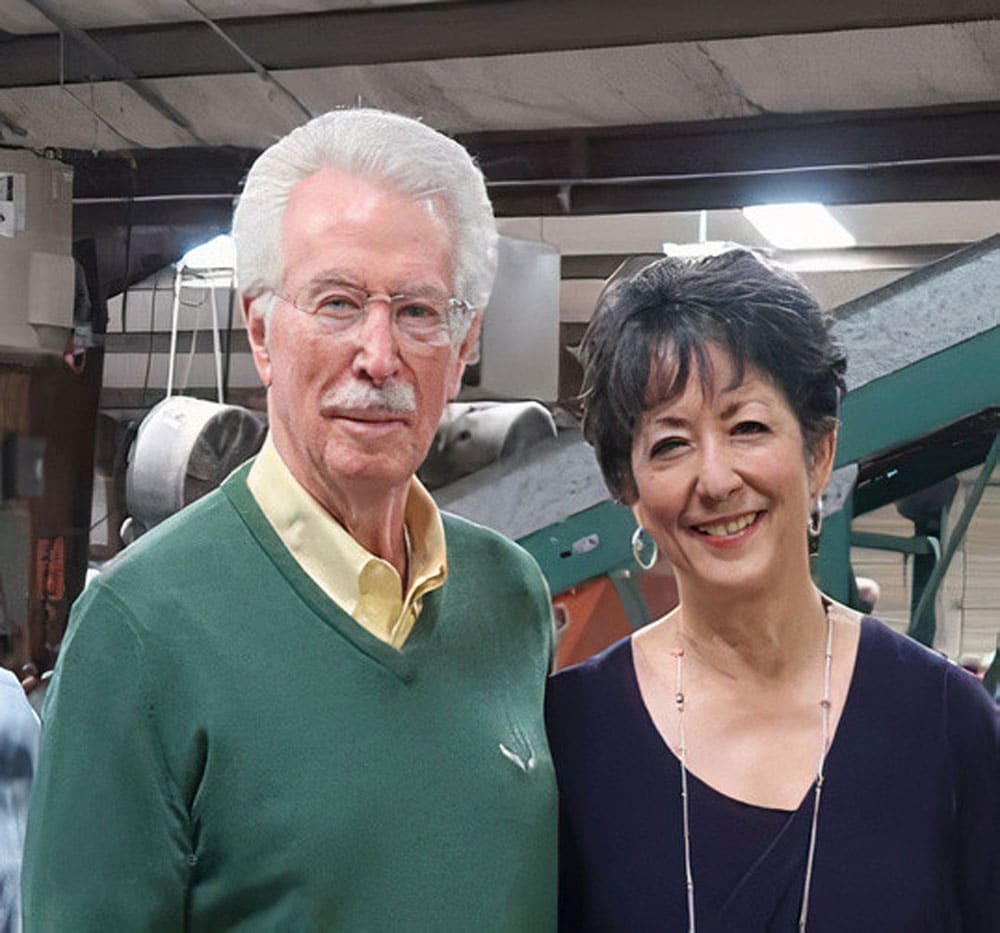

Arch W. (Bill) Hunt, PhD

Chairman

Carmen Y. Hunt, MBA

President

Bill finished Baylor University with BS and MS degrees in Mathematics and Physics. He entered the USAF as a 2nd Lieutenant, stationed at Wright Patterson AFB, Ohio. He served as an engineer, specializing in infrared guidance for air-to-air missiles. Upon completion of his active duty, he remained in the Air Force Reserves, serving as an operations analyst and Air Force Academy Liaison Officer, and retiring as a Lt. Colonel.

Bill spent time as an Engineer at Hughes Aircraft Company and a Project Operations Analyst at General Dynamics. Acquiring an interest in operations research and management, Bill left the defense industry to obtain a PhD degree in Operations Research, Statistics, and Accounting at the University of Texas at Austin. Upon completion, Bill received an appointment as Assistant Professor of Operations Research in the College of Business at UT Austin. Ultimately, he became the Assistant Vice President for Academic Affairs. He followed his leader to become Assistant to the President and Director of Management Information Systems, assisting in the development of the new University of Texas at San Antonio.

During his time in San Antonio, he spent nearly two years teaching MBA coursework, under contract for Boston University in Italy and Germany, to military and civil servants. Also, he taught a semester at the Monterrey Institute of Technology in Mexico.

Intrigued with private enterprise, Bill took a position with Fuddruckers Restaurants as Vice President and Controller. He brought his wife, Carmen, on board as the Director of the management training programs, initiated franchising, and inventory/accounting control systems. Ultimately, Bill and Carmen decided to take the franchise rights to the State of Tennessee and proceeded to build several restaurants in Nashville and Knoxville, Tennessee.

After a decade in the restaurant business, wanting to return to Texas, Bill became the President of a large textile recycling company in Dallas, Texas. He steered the company into the computer age, organizing production, data base management, and sales. Health issues caused a change in course.

In 1996, Bill and Carmen decided to raise capital and start a new corporation in Athens, Texas called Texas Ragtime, Inc. It was started in a portion of the old Curtis Mathes television production facility. As a Brownfield site, our lease provided impetus in cleaning and removing the old facility from the tainted property list. After about 10 years, the company found a permanent location, just north of Athens. The facility contains about 85,000 square feet on seven acres of land.

In semi-retirement, Bill still handles the day-to-day financial operations and continues to analyze operations to assist in the development and maintenance of sound operating procedures and corporate growth.

Carmen graduated from the University of Texas at San Antonio with BBA and MBA degrees. She became an insurance adjuster for a large San Antonio insurance company. Later, she became a marketing representative for another insurance company.

With the growth of the Fuddruckers restaurant chain as a result of internal and franchisee growth, it became imperative that a recruitment and training program be initiated as soon as possible. Carmen accepted the responsibility to join Bill at Fuddruckers to develop a solid manager recruitment and training program. It was highly successful in satisfying corporate and franchisee management requirements.

Carmen joined Bill in the development of the Tennessee franchise territory. Again, Carmen recruited and trained the personnel – managers, cooks, butchers, bakers, cashiers, etc. for the three Fuddruckers in Nashville and Knoxville locations. In addition, three other non-franchise restaurants were started, including full-service and cafeteria-style concepts.

After a decade, Carmen moved to Dallas and, ultimately, to Athens, Texas to assist Bill in financing, recruitment, and training staff for Texas Ragtime, Inc. It was a very tough time to develop a newly formed company, with the global economies struggling with recessions, currency issues, and internal upheavals, all of which impacted small, start-up companies. Carmen and Bill worked as a solid team with a dedicated staff to establish Texas Ragtime as one of the largest textile recycling companies in the USA!

Our mission today is to continue to provide the level of service and quality products that our customers have come to appreciate for over twenty-five years!

Kevin D. Cook, BBA

Vice President of Operations

Kevin has a BBA in accounting from University of Texas at Tyler. He performs the lion’s share of accounting duties. As a former general manager of a national paint and coatings retailer, he understands the challenges many contractors and job supervisors face trying to source a quality product at the best price. He heads up the team to source products for many diverse industries to solve any clean-up requirements with the best products which suit their needs.

Arthur Cruz

Director of Sales

Arthur graduated from the University of Texas at San Antonio with a B.A. degree. He served our country in the United States Marine Corps, where he served in the infantry and security forces prior to being Honorably Discharged.

After many years in a wide variety of businesses, such as full-service restaurant management, petroleum products distribution. He served as a manufacturer’s representative for Texas Ragtime before joining the company as Director of Sales and Marketing. Arthur has developed a skill set beyond the mere selling of a product. He knows that selling involves product knowledge and serving the customer with honesty and superior service.

He came on board full-time in 2017.

Blanca Miranda

Sales & Help Desk

Blanca has been with Texas Ragtime since the company started in 1997. She worked in the grading department and soon rose up to a supervisory role in production. In 2019, Blanca got into ecommerce and social media to help out in the ever expanding marketing efforts to push Texas Ragtime products in the digital age.

Today, you will find Blanca at the sales and help desk at Texas Ragtime. She is the friendly voice you hear when you call our company as well as the smiling face you first see when you step into the office. She is bilingual and will happily help customers in English or Spanish.

Blanca ha estado en Texas Ragtime desde que la compañía comenzó en 1997. Trabajo en el departamento de clasificación y pronto asumió el cargo de supervisora de producción en 2019. Blanca ingreso al comercio electrónico y las redes sociales para ayudar en los esfuerzos de la mercadotecnia en la constante expansión para impulsar los productos de Texas Ragtime en la era digital.

Hoy encontrara a Blanca en la mesa de ayuda y ventas de Texas Ragtime, ella es la voz amistosa que escucha cuando llama a nuestra compañía, así como la cara sonriente que ve por primera vez cuando ingresa a la oficina. Ella es bilingüe y felizmente ayudara a nuestros clientes en Ingles o español.

Our Philosophy

As part of our corporate philosophy of working toward a more environmentally friendly workplace, we have implemented certain purchasing and other initiatives to reduce landfill waste and conserve energy. Our manufactured cardboard packaging utilizes post-consumer paper products. We also recycle all baling wire, cardboard, and other metals from our daily operations. Our factory and office lighting have been retrofitted to LED lighting, saving hundreds of dollars in maintenance costs as well as energy costs. Programmable thermostats and paperless office transactions contribute further to our goal of saving energy.

Let us answer any questions you may have about our wipers or absorbents! Send a request on our Contact Us page or call toll free at 1-800-670-7338. (M-F 7 AM to 3:30 PM)